chel-olimp.ru

Overview

Can You Load A Check On Cash App

You can cash a check in the PayPal app by taking a photo of both sides of your signed check and choosing when you want to receive the money in your PayPal. Once everything is accurately verified, the teller will give you cash for the check. It's important to note, some banks charge a fee when cashing checks for non. Deposit paychecks, tax returns, and more to your Cash App balance using your account and routing number. You can receive up to $25, per direct deposit. If you have a Square Checking account, you can make check deposits, and add money to your checking account right from your Point of Sale app. To do so. Cash App, which is backed by the Square payment network, allows you to receive direct deposits, pay bills, and even withdraw cash or pay in-store with a linked. Cash checks on a mobile device anytime, anywhere. Get your money in minutes in your bank, PayPal, and prepaid card accounts. You can deposit paper money into your Cash App balance at participating retailers Kwik Check Foods; KwikTrip; Kum & Go; Mariano's; Metro Market; Pay-Less. Cash checks on a mobile device anytime, anywhere. Get your money in minutes in your bank, PayPal, and prepaid card accounts. You can deposit paper money into your Cash App balance at participating retailers. Cash App charges a flat-rate $1 processing fee on each paper money deposit. You can cash a check in the PayPal app by taking a photo of both sides of your signed check and choosing when you want to receive the money in your PayPal. Once everything is accurately verified, the teller will give you cash for the check. It's important to note, some banks charge a fee when cashing checks for non. Deposit paychecks, tax returns, and more to your Cash App balance using your account and routing number. You can receive up to $25, per direct deposit. If you have a Square Checking account, you can make check deposits, and add money to your checking account right from your Point of Sale app. To do so. Cash App, which is backed by the Square payment network, allows you to receive direct deposits, pay bills, and even withdraw cash or pay in-store with a linked. Cash checks on a mobile device anytime, anywhere. Get your money in minutes in your bank, PayPal, and prepaid card accounts. You can deposit paper money into your Cash App balance at participating retailers Kwik Check Foods; KwikTrip; Kum & Go; Mariano's; Metro Market; Pay-Less. Cash checks on a mobile device anytime, anywhere. Get your money in minutes in your bank, PayPal, and prepaid card accounts. You can deposit paper money into your Cash App balance at participating retailers. Cash App charges a flat-rate $1 processing fee on each paper money deposit.

How can I access mobile check deposit? · Endorse (sign) the back of the check · Open the One app · Open Cash Control · Choose Deposit Check · Enter the amount of the. CASH CHECKS AND GET YOUR MONEY IN MINUTES With the Ingo® Money App, cash paychecks, business checks, personal checks—almost any type of check—anytime. Cash App direct deposits are made available as quickly as possible once they're sent: while Cash App itself doesn't mention a specific time of the day on their. You can add money from checks directly to your spendwell account using the Mobile Check Capture feature in the spendwell Mobile App on your iPhone® or. You can deposit a check directly through the Cash App — and the better news is that it's more convenient than going to a bank once you know how to do it. 4 Steps on How to Mobile Deposit a Check · Sign In: Open the app and sign in with your credentials. · Select 'Deposit': On the bottom of the screen, choose the '. Cash a check with our mobile app and, if approved, get your money in minutes. Just snap a few pictures with your phone and the money can be loaded to a debit. You can have your check direct deposited into your Cash App account but you cannot mobile deposit the check. Subscribe to my YouTube channel. This comprehensive guide will explore the reasons behind this issue and provide detailed steps on how to enable the check deposit feature on your Cash App. Mobile check deposit lets you deposit checks into your U.S. Bank account using the camera on your phone or tablet. Here's how it works: 1. Sign your check. CASH CHECKS AND GET YOUR MONEY IN MINUTES With the Ingo® Money App, cash paychecks, business checks, personal checks—almost any type of check—anytime. With the Ingo® Money App, cash paychecks, business checks, personal checks—almost any type of check—anytime, anywhere. Get your money in minutes. How can I access mobile check deposit? · Endorse (sign) the back of the check · Open the One app · Open Cash Control · Choose Deposit Check · Enter the amount of the. Tap the Money tab on your Cash App home screen · Tap Direct Deposit · Select Get Direct Deposit Form · Fill out your employer information, the amount you would. With the Ingo® Money App, cash paychecks, business checks, personal checks—almost any type of check—anytime, anywhere. Get your money in minutes. Bank the way you want—without all the fees. Advanced Security features protect your account. Get paid up to 2 days early with direct deposit. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. How to deposit a check with your phone Log in to your Walmart MoneyCard app. Log in to your Walmart MoneyCard app. Select Deposit & then Deposit A Check. Depositing a cheque online via a mobile app can be very convenient as it eliminates the need to go to a physical bank branch. Hold times on cheques deposited. Mobile deposit is part of the Wells Fargo Mobile® app - all you need to do is download and open our app to get started. check the box that reads: “Check here.

Are Etfs A Good Investment

Exchange-traded funds (ETFs) are a type of investment offering investors easy access to a wide range of markets and assets. The differences between this Fund and other ETFs may also have advantages. By keeping certain information about the Fund secret, this Fund may face less risk. ETFs often generate fewer capital gains for investors than mutual funds. This is partly because so many of them are passively managed and don't change their. Exchange-traded funds (ETFs) are SEC-registered investment companies that offer investors a way to pool their money in a fund that invests in stocks, bonds. ETFs offer built-in diversification and don't require large amounts of capital in order to invest in a range of stocks, they are a good way to get started. Given all these features, ETFs can be a worthwhile addition to a portfolio. They ETFs may yield investment results that, before expenses, generally. Both are less risky than investing in individual stocks & bonds. ETFs and mutual funds both come with built-in diversification. · Both offer a wide variety of. In fact, the average fund investor significantly underperforms the market over time, and over-trading is the main reason. So, once you buy shares of some great. I think a lot of people underestimate the risk of ETF's, they are a good vehicle to invest in, but they are still financial products. But in. Exchange-traded funds (ETFs) are a type of investment offering investors easy access to a wide range of markets and assets. The differences between this Fund and other ETFs may also have advantages. By keeping certain information about the Fund secret, this Fund may face less risk. ETFs often generate fewer capital gains for investors than mutual funds. This is partly because so many of them are passively managed and don't change their. Exchange-traded funds (ETFs) are SEC-registered investment companies that offer investors a way to pool their money in a fund that invests in stocks, bonds. ETFs offer built-in diversification and don't require large amounts of capital in order to invest in a range of stocks, they are a good way to get started. Given all these features, ETFs can be a worthwhile addition to a portfolio. They ETFs may yield investment results that, before expenses, generally. Both are less risky than investing in individual stocks & bonds. ETFs and mutual funds both come with built-in diversification. · Both offer a wide variety of. In fact, the average fund investor significantly underperforms the market over time, and over-trading is the main reason. So, once you buy shares of some great. I think a lot of people underestimate the risk of ETF's, they are a good vehicle to invest in, but they are still financial products. But in.

An ETF provides diversification to that active manager and helps you to build a better portfolio. So regardless of the investor and their experience an ETF, if. With a plethora of indexes in the investing universe, how do investors pick? Financial professionals can help investors determine the appropriate index by. As investment companies, ETFs are subject to the regulatory Whether your investment needs are better served by investing in an ETF or in. ETFs are wonderful instruments offering diversification at a minimal cost. Indeed, ETFs are investment vehicles containing many investments and are therefore. Exchange-traded funds (ETFs) can be a great investment vehicle for small and large investors alike. These popular funds, which are similar to mutual funds. ETFs can offer lower operating costs than traditional open-end funds, flexible trading, greater transparency, and better tax efficiency in taxable accounts. Vanguard Index ETF · Large blend · $ billion · % · %, or $3 annually for every $10, invested ; Vanguard Dividend Appreciation ETF · Large blend. ETFs can give you an efficient way to diversify your portfolio, without having to select individual stocks or bonds. · Typically, they cover most major asset. ETFs and mutual funds both offer diversified investment opportunities but have different investment objectives. good times and bad. Expense ratio: The. Absolutely. A trusted advisor can not only help you to decide if ETFs are a good choice for your portfolio but assist you in choosing ones that best suit your. Investors have a good choice of ETFs when it comes to hedging against inflation. Two of the most popular ETFs include index funds based on the Standard & Poor'. I think ETFs are the way to go. And one ETF in particular to start with. SPY, which is the S&P Risks are diversified. Costs are very low. ETFs are transparent and show the underlying investments, which is not always the case with mutual funds. Capital risk: like all investment products, the value. Have you considered exchange-traded funds (ETFs)?. ETFs can be used as the building blocks of your portfolio or as a complement to other investments you own. Exchange-traded-funds, or ETFs, are similar to mutual funds in that they invest in a basket of securities, such as stocks, bonds, or other asset classes. Neither mutual funds nor ETFs are perfect. Both can offer comprehensive exposure at minimal costs, and can be good tools for investors. The choice comes down to. ETFs except inverse ETFs, are well-suited for long-term investing due to their diversified nature and low-cost structure. ETFs also allow you to invest in markets or assets it can be difficult or expensive to access. You can also diversify across ETFs so there's less chance of loss. ETFs are often compared to mutual funds because they pool investors' assets and use professional fund managers to invest the money according to a specific. When breaking it out by asset class, active bond ETF managers did better than active bond mutual fund managers; 71% of the ETFs beat their benchmark while only.

Pamm Trading

A PAMM account is a type of forex trading account that allows you to allocate a portion of your funds to experienced traders, called money managers. Traders in a PAMM account are called fund managers or masters, and investors are called followers because they follow their master's trading. PAMM account allows traders to manage multiple accounts from a single account without creating an investment fund. Managers enjoy large volumes at the prices. Managed Account (PAMM) is a variation of asset management when a manager uses funds of multiple investors on a single account. All the profits or losses are. Taurex PAMM Service. Join our PAMM service today and experience the simplicity of hands-off trading. Fund Managers of your choice will trade for you. Join Orbex as a PAMM Fund Manager (PAMM.M) and allow other traders to invest in your trading strategy. Create a large pool of funds and set a performance fee. PAMM is a sort of pooled money Forex trading in which investors pool their money with a professional trader (Money Manager) who buys and sells assets on their. PAMM is a sort of pooled money Forex trading in which investors pool their money with a professional trader (Money Manager) who buys and sells assets on their. Launch PAMM accounts and offer investment opportunities for all clients who are interested in financial markets but not ready to trade on their own. A PAMM account is a type of forex trading account that allows you to allocate a portion of your funds to experienced traders, called money managers. Traders in a PAMM account are called fund managers or masters, and investors are called followers because they follow their master's trading. PAMM account allows traders to manage multiple accounts from a single account without creating an investment fund. Managers enjoy large volumes at the prices. Managed Account (PAMM) is a variation of asset management when a manager uses funds of multiple investors on a single account. All the profits or losses are. Taurex PAMM Service. Join our PAMM service today and experience the simplicity of hands-off trading. Fund Managers of your choice will trade for you. Join Orbex as a PAMM Fund Manager (PAMM.M) and allow other traders to invest in your trading strategy. Create a large pool of funds and set a performance fee. PAMM is a sort of pooled money Forex trading in which investors pool their money with a professional trader (Money Manager) who buys and sells assets on their. PAMM is a sort of pooled money Forex trading in which investors pool their money with a professional trader (Money Manager) who buys and sells assets on their. Launch PAMM accounts and offer investment opportunities for all clients who are interested in financial markets but not ready to trade on their own.

This software means investors can be part of a set of sub-accounts which are traded together by a money manager or trader who has permission from clients to. The Percentage Allocation Money Management (PAMM) is a form of integrated trading in exchange markets. You can either become an investor or money manager. The. The PAMM service facilitates the relationship between an endless amount of world-class Skilled Masters & eager Followers. Our PAMM trading accounts offer a seamless solution for both investors and managers to maximize returns in the financial markets. PAMM stands for Percentage Allocation Money Management. This unique kind of trading setup allows investors to allocate funds to a qualified trader or money. Explore PAMM trading with NordFX and invest with expert traders. Benefit from professional management and diversify your portfolio with forex, crypto. Investors set adjustable loss limits · Master adjusts visibility of positions for investors to protect trading strategy · PAMM offers two logic options: one. What is PAMM Trading. Share. PAMM (Percentage Allocation Management Module) is a form of trading on the Forex market, where the investor distributes his money. K subscribers in the Forex community. Welcome to chel-olimp.ru's Reddit Forex Trading Community! Here you can converse about trading ideas. The PAMM account is a unique product that allows investors to earn without having to trade. You can invest your funds in the accounts of traders, who receive a. PAMM account allows traders to manage multiple accounts from a single account without creating an investment fund. Managers enjoy large volumes at the prices. It allows investors to yield profits without trading and enables PAMM traders to earn additional income from managing attracted investments. For Investors For. PAMM vs Copy Trade · With a copy trading account, the investor can make decisions, this is not possible with a PAMM accounts. In fact, with a PAMM account, the. Percentage Allocation Money Management (PAMM) solution is a trading tool that allows experienced traders to execute trades on behalf of investors. The PAMM. Brokeree Solutions' MT4/MT5 PAMM is an investment system that allows traders to follow the strategies of more experienced traders – money managers, by joining. Discover the ranking of the best FXOpen PAMM Managers (Masters) and Followers. Explore detailed stats on each FXOpen PAMM trader and the biggest gainers. PAMM accounts are a means of bringing investors and traders together to earn from trading under a single account. As a PAMM manager on FxPro, you manage a pooled account combining funds from multiple investors. You execute your forex trading strategy on this account, and. With PAMM accounts, the investor will be entrusting their money to a third party who will trade on behalf of the investor.

Best Place To Get A Mortgage From

Apply for financing and get the mortgage that meets your needs. I already Top home mortgage FAQs. How does my credit rating affect my home loan. Mortgage Loans. Buying a home is a uniquely personal experience. For you, it may be the first place that's all your own. Maybe it means getting. The 10 best mortgage lenders of August — and how to get their lowest rates · Guaranteed Rate · Pennymac · Bank of America · Alliant Credit Union · Wells Fargo. I paid a lot on my mortgage. I tried to refinance it and got a great offer from this site: chel-olimp.ru They work with all banks. Known for its streamlined mortgage process, Rocket is among the best online mortgage lenders. It placed first in mortgage servicer satisfaction and second in. Loans. Find out which SBA-guaranteed loan program is best for your business, then use Lender Match to be matched to lenders. Find lenders. Best mortgage lenders ; Ally: Best on a budget. ; Better: Best for FHA loans. ; Bank of America: Best for closing cost assistance. ; USAA: Best for low origination. Best for Single-Family Homes: Citibank Citibank is our choice as the best investment property lender for single-family homes because it offers a full toolbox. The best mortgage lenders ; Best for lower credit scores: Rocket Mortgage ; Best for flexible down payment options: Chase Bank ; Best for no · Ally Bank ; Best for. Apply for financing and get the mortgage that meets your needs. I already Top home mortgage FAQs. How does my credit rating affect my home loan. Mortgage Loans. Buying a home is a uniquely personal experience. For you, it may be the first place that's all your own. Maybe it means getting. The 10 best mortgage lenders of August — and how to get their lowest rates · Guaranteed Rate · Pennymac · Bank of America · Alliant Credit Union · Wells Fargo. I paid a lot on my mortgage. I tried to refinance it and got a great offer from this site: chel-olimp.ru They work with all banks. Known for its streamlined mortgage process, Rocket is among the best online mortgage lenders. It placed first in mortgage servicer satisfaction and second in. Loans. Find out which SBA-guaranteed loan program is best for your business, then use Lender Match to be matched to lenders. Find lenders. Best mortgage lenders ; Ally: Best on a budget. ; Better: Best for FHA loans. ; Bank of America: Best for closing cost assistance. ; USAA: Best for low origination. Best for Single-Family Homes: Citibank Citibank is our choice as the best investment property lender for single-family homes because it offers a full toolbox. The best mortgage lenders ; Best for lower credit scores: Rocket Mortgage ; Best for flexible down payment options: Chase Bank ; Best for no · Ally Bank ; Best for.

Academy Mortgage Corp, , X ; Androscoggin Savings Bank, , X ; Bangor Savings Bank, , X ; Bar Harbor Bank & Trust, Academy Mortgage Corp, , X ; Androscoggin Savings Bank, , X ; Bangor Savings Bank, , X ; Bar Harbor Bank & Trust, The Federal Housing Administration (FHA) - which is part of HUD - insures the loan, so your lender can offer you a better deal. Low down payments; Low closing. You can choose a mortgage from all kinds of financial institutions, including banks, credit unions and online mortgage lenders like Rocket Mortgage and. Summary of Top Lenders · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City · AmeriSave. Shop around, don't just go to the big banks. Check out local credit unions and mortgage brokers. For mortgage brokers: chel-olimp.ru You want nothing but the best for your family, and that's why our team is consistently top rating as the best mortgage lender in Texas and the surrounding areas. Wells Fargo Home Mortgage offers competitive rates on a variety of home loan options. Visit Wells Fargo today to check rates and get mortgage financing. The more knowledgeable you are before you approach lenders, the better deal you're likely to get. Look in your local paper to see what rates are being. NBKC Bank: Best for closing cost guarantees · Mutual of Omaha: Best for customer reputation · Rocket Mortgage: Best for borrowers with low or bad credit · Allied. View rates, learn about mortgage types and use mortgage calculators to help find the loan right for you. Prequalify or apply for your mortgage in minutes. Best Mortgage Lenders in Minneapolis, MN · Fairway Independent Mortgage Corporation · NorthPort Funding · Progressive Lending Solutions · Flagship Bank · Sterling. How to find the best mortgage lender · Prepare to work with a lender · Shop lenders · Ask critical questions · Read lender reviews · Compare loan estimates. VA Home Loans are provided by private lenders, such as banks and mortgage companies. Find a VA location. Language assistance. Español · Tagalog · Other. CMG Financial, , ; Columbia Credit Union, , ; Cornerstone Home Lending, Inc, , ; CrossCountry Mortgage. Licensing & Awards. Show off your Top Mortgage Lenders status with official awards and logos. Find out more. Best for Single-Family Homes: Citibank Citibank is our choice as the best investment property lender for single-family homes because it offers a full toolbox. Better Inspect, LLC maintains its corporate headquarters at Chestnut Street, Suite , Philadelphia, PA Better Mortgage Corporation, Better Real. Top Loan Officers ; CMG Home Loans. ; Pinnacle Mortgage Corp. These include local banks, credit unions, and large banks, or you can also choose to go through a mortgage broker. In certain cases, different lenders will.

How Much Will My Roth Ira Be Worth

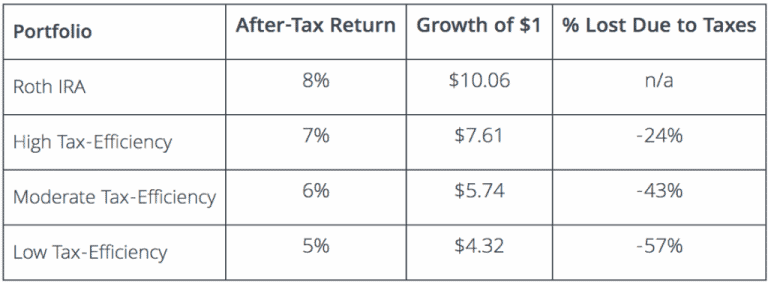

With our IRA calculators, you can determine potential tax implications, calculate IRA growth, and ultimately estimate how much you can save for retirement. Roth IRA vs Taxable Account. At retirement your IRA balance could be worth $, Definitions. Starting balance. The current balance of your Roth IRA. Use our Roth IRA Calculator and find out how contributing makes a big difference in your retirement savings. Use this free Roth IRA calculator to estimate your account balance at retirement and determine how much you are eligible to contribute in With this Roth IRA calculator, you can calculate how much your retirement savings account will generate. This estimate can help you assess the potential. How much will my Roth IRA be worth at retirement? Use this calculator to compute the amount you can save in a Roth IRA where you pay taxes on your income now. This calculator estimates the balances of Roth IRA savings and compares them with regular taxable account. It is mainly intended for use by US residents. A Roth IRA may be worth $27, more than a traditional IRA. *indicates If your income exceeds the phase-out range, you do not qualify for any Roth IRA. At the end of the first year, you would have the same balance as if you earned simple growth: $14, But at the end of the second year, you would have $26, With our IRA calculators, you can determine potential tax implications, calculate IRA growth, and ultimately estimate how much you can save for retirement. Roth IRA vs Taxable Account. At retirement your IRA balance could be worth $, Definitions. Starting balance. The current balance of your Roth IRA. Use our Roth IRA Calculator and find out how contributing makes a big difference in your retirement savings. Use this free Roth IRA calculator to estimate your account balance at retirement and determine how much you are eligible to contribute in With this Roth IRA calculator, you can calculate how much your retirement savings account will generate. This estimate can help you assess the potential. How much will my Roth IRA be worth at retirement? Use this calculator to compute the amount you can save in a Roth IRA where you pay taxes on your income now. This calculator estimates the balances of Roth IRA savings and compares them with regular taxable account. It is mainly intended for use by US residents. A Roth IRA may be worth $27, more than a traditional IRA. *indicates If your income exceeds the phase-out range, you do not qualify for any Roth IRA. At the end of the first year, you would have the same balance as if you earned simple growth: $14, But at the end of the second year, you would have $26,

How Does a Roth IRA Work? You can put money you've already paid taxes on into a Roth IRA. When you withdraw earnings once you retire at age 59½ or later and. At retirement your IRA balance could be worth $, *indicates The amount you will contribute to your Roth IRA each year. This calculator. This calculator estimates the balances of Roth IRA savings and compares them with regular taxable account. It is mainly intended for use by US residents. At the end of the first year, you would have the same balance as if you earned simple growth: $14, But at the end of the second year, you would have $26, Roth IRA vs Taxable Account. At retirement your IRA balance could be worth $, Definitions. Starting balance. The current balance of your Roth IRA. chel-olimp.ru provides a FREE k or Roth IRA calculator and other (k) calculators to help consumers determine the best option for retirement possible.'. chel-olimp.ru provides a FREE Roth IRA calculator and other k calculators to help consumers determine the best option for retirement savings. A Traditional, SIMPLE, or SEP IRA account can accumulate $93, more after-tax balance than a Roth IRA account at age A Roth IRA account can accumulate. At retirement your IRA balance could be worth $, *indicates required. Roth IRA savings. Compare Traditional and Roth IRA options to a general (taxable) investment account and see how certain assumptions can impact your retirement strategy. With this Roth IRA calculator, you can calculate how much your retirement savings account will generate. This estimate can help you assess the potential. For example, if you have a 25% income tax rate and contribute $1, to your retirement account, the actual cost after taxes would be $ for the traditional. Is there a penalty for contributing too much to my IRA(s)?. Contributing If you have Roth IRAs, your income could affect how much you can contribute. Because converting will require you to pay taxes on the amount converted, we'll help you compare the impact of paying taxes on the converted amount today vs. The calculator will estimate the monthly payout from your Roth IRA in retirement. It will also estimate how much you'll save in taxes, since earnings on funds. Enter a few step-by-step details in our Roth vs. Traditional IRA Calculator to see which type of retirement account may be right for you and how much you can. Because this is a Roth IRA, your contribution limit is after taxes and your effective contribution limit is higher than a Traditional IRA. This calculator. Use our Roth IRA Calculator and find out how contributing makes a big difference in your retirement savings. The Roth IRA can provide truly tax-free growth. Roth IRA Calculator. How much will your Roth IRA be worth when you retire? Learn how much you'. If you are in a % tax bracket now, your after tax deposit amount would be $3, You will save $, over 20 years.

Google How Much Is Gold An Ounce

Live Gold Charts and Gold Spot Price from International Gold Markets, Prices ounce. 2, gram. Kilo. 79, Today's gold price in United States is $ USD per ounce. Get detailed information, charts, and updates on gold rates in major cities of United States. On this page you can view the current price of gold per ounce, gram or kilo. Gold is usually quoted by the ounce in U.S. Dollars. The gold price can. 1 Oz Gold Bar Values ; 1 oz Gold Bar - Secondary Market, $2, Buy Now ; 1 oz Gold Bar - Brand Name (w/Assay Card), $2, Buy Now ; 1 oz Gold Bar -. This all led to a surge in gold prices in the s, reaching a record high of around $ in January ; Gold reached a local low of about $ per ounce. Gold not only has a spot price, but it also has the LBMA Gold Price, as well as several regional prices. Prices are quoted in currency unit per troy ounce. What is the price of one gram of gold today? · Today, the spot price for a gold ounce is € and $ · The price for an ounce of GoldPremium is €. The chart above shows the price of Gold in USD per Troy Ounce for Last 10 Years. You can access information on the Gold price in British Pounds (GBP), Euros . Currently, the US dollar spot price for 1 ounce of gold is $2, and in Canadian dollars C$3, However, it's possible to track the real-time changing. Live Gold Charts and Gold Spot Price from International Gold Markets, Prices ounce. 2, gram. Kilo. 79, Today's gold price in United States is $ USD per ounce. Get detailed information, charts, and updates on gold rates in major cities of United States. On this page you can view the current price of gold per ounce, gram or kilo. Gold is usually quoted by the ounce in U.S. Dollars. The gold price can. 1 Oz Gold Bar Values ; 1 oz Gold Bar - Secondary Market, $2, Buy Now ; 1 oz Gold Bar - Brand Name (w/Assay Card), $2, Buy Now ; 1 oz Gold Bar -. This all led to a surge in gold prices in the s, reaching a record high of around $ in January ; Gold reached a local low of about $ per ounce. Gold not only has a spot price, but it also has the LBMA Gold Price, as well as several regional prices. Prices are quoted in currency unit per troy ounce. What is the price of one gram of gold today? · Today, the spot price for a gold ounce is € and $ · The price for an ounce of GoldPremium is €. The chart above shows the price of Gold in USD per Troy Ounce for Last 10 Years. You can access information on the Gold price in British Pounds (GBP), Euros . Currently, the US dollar spot price for 1 ounce of gold is $2, and in Canadian dollars C$3, However, it's possible to track the real-time changing.

Gold Price in US Dollars is at a current level of , down from the previous market day and up from one year ago. This is a change of. Gold prices today ; US Dollar (USD), , $2, ; British Pound (GBP), , £1, ; Swiss Franc (CHF), , CHF 2, ; Australian Dollar (AUD), In addition to having really strong bids on gold, silver, platinum, and palladium in coin and bullion form, we also purchase a wide range of numismatic coins. Today's gold price of $2, per troy ounce is down by % from the price of $2, one week ago. Read more on gold price analysis, comparisons. Gold Price Per Ounce, $ 2,, ; Gold Price Per Gram, $ , ; Gold Price Per Kilo, $ 80,, Gold Price per Ounce. Gold Price per Ounce. 2, ▽ Gold Price per Partner - Google; Partner - BBB. WE ACCEPT. © Silver Gold Bull, Inc. This all led to a surge in gold prices in the s, reaching a record high of around $ in January ; Gold reached a local low of about $ per ounce. Gold prices today ; US Dollar (USD), , $2,, $79,, $ ; British Pound (GBP), , £1,, £61,, £ View the live gold spot price per troy ounce, gram, and kilogram. You can also see the hour price trend for each weight. Current Gold Price - The Best Way to Track the Movements in the Current Gold Rate in dollars. 1 Troy Ounce ≈ 1, Ounce, Gold Price Per 1 Ounce, USD ; 1 Troy Ounce ≈ 31,10 Gram, Gold Price Per 1 Gram, USD. We provide real-time updates on the current price of gold per ounce, ensuring investors and traders have access to the most recent and accurate market data. Gold is expected to trade at USD/t oz. by the end of this quarter, according to Trading Economics global macro models and analysts expectations. Looking. So the same daily price of gold is how much an ounce of 24 karat gold is. Google Rating. Based on 74 reviews. js_loader. Gold Price ; Bid / Ask, $, $ ; Low / High, $, $ ; Change, ▽-$, ▽%. Live Gold Price ; GOLD USD/Oz, , ; GOLD EUR/Oz, , ; GOLD GBP/Oz, , ; Gold USD/1g, , Live Gold Prices | Price of Gold Per Ounce ; Live Gold Price per Ounce, $2,, $ ; Live Gold Price per Gram, $, $ ; Live Gold Price per Kilo. Gold Price Per Gram $ + ; Gold Price Per Ounce $2, + ; Gold Price Per Kilogram $80, + chel-olimp.ru - The No. 1 gold price site for fast loading live gold price charts in ounces, grams and kilos in every national currency in the world. Money Metals Live Gold Spot Prices. Gold Spot Price, Spot Change. Gold Price per Ounce, $2, %. Gold Price per Gram, $ %. Gold.

How To Remove Collection Account

Even if you paid off a collections account, it will appear on your report for up to 7 years. An exception is medical debt, which is removed from your credit. Most service providers have a written policy about past-due accounts and will send your account to a collection agency after a certain time period—typically A new collection account may show up on your credit reports. First, you'll have 30 days to dispute the validity of the debt if you disagree with it. Your. Usually include the account number of original creditor; Explain where your payments should now go. If you are not sure which debt has been sold, contact the. Creditors and debt collectors have no obligation to remove charge-offs from a credit report. Ensure you get everything in writing if you're able to work out a. 1. Verify the Debt: First, make sure the collection account is legitimate. Request written verification of the debt from the collection agency. 3 ways to potentially get collection accounts removed from your credit report · 1. Send a pay for delete letter · 2. Request a goodwill deletion · 3. Dispute the. Prepaid Account Agreements. Featured. Help advance / Debt Collection. last reviewed: MAY 14, How do I get a debt collector to stop calling or. If the charged-off account belongs to you and all the information being reported about it is accurate, you could try negotiating with the creditor or debt. Even if you paid off a collections account, it will appear on your report for up to 7 years. An exception is medical debt, which is removed from your credit. Most service providers have a written policy about past-due accounts and will send your account to a collection agency after a certain time period—typically A new collection account may show up on your credit reports. First, you'll have 30 days to dispute the validity of the debt if you disagree with it. Your. Usually include the account number of original creditor; Explain where your payments should now go. If you are not sure which debt has been sold, contact the. Creditors and debt collectors have no obligation to remove charge-offs from a credit report. Ensure you get everything in writing if you're able to work out a. 1. Verify the Debt: First, make sure the collection account is legitimate. Request written verification of the debt from the collection agency. 3 ways to potentially get collection accounts removed from your credit report · 1. Send a pay for delete letter · 2. Request a goodwill deletion · 3. Dispute the. Prepaid Account Agreements. Featured. Help advance / Debt Collection. last reviewed: MAY 14, How do I get a debt collector to stop calling or. If the charged-off account belongs to you and all the information being reported about it is accurate, you could try negotiating with the creditor or debt.

Even if you paid off a collections account, it will appear on your report for up to 7 years. An exception is medical debt, which is removed from your credit. If you owe a debt, act quickly — preferably before it's sent to a collection agency. Contact your creditor, explain your situation and try to create a payment. After you receive the collector's response, if you still don't think you owe the money, write the collector a letter disputing the debt. 2. Written Collection. Once the agency receives your letter, they may not contact you again except to say there will be no further contact, or to notify you if the debt collector or. How to Request Pay for Delete · Your name and address · The creditor's or collection agency's name and address · The name and account number you're referencing · A. If the collection agency is unable to obtain verification that you owe the debt, they may return your account to the creditor and stop collection efforts. The. If you've been making regular payments before your debt entered collections, you might be able to request the collection agency to remove the entry from your. First, review your collection/charge-off accounts then answer the following question: Are your collections and charge-offs accurate or inaccurate? For. Law Library. show navigation menu my account search | help | contact. Ask Tags: charge off, collections, creditors, debt, debt buyers, debt collector. The debt collector could then garnish your wages and bank accounts, meaning it could take money from your paycheck or accounts. Make sure you respond by the. With the counselor's help, call the collections agency and arrange a payment plan so the delinquent marks roll off your credit report as quickly as possible. The collection agency must wait 6 days before they attempt to contact you to collect payment of the debt after sending the notice letter. They can continue to. Lenders commonly send credit card accounts to a collection agency after days of non-payment. Either the original creditor or the collection agency may. delete technique is the easiest way to remove collections from your credit removing the collection account. Points to note in the letter: If true. Bank account garnishment. A creditor who garnishees your bank account is allowed to take the entire amount of money that you owe. Objection to a garnishment. To. The right debt recovery tools can greatly increase your financial return. They enable you to segment debts, prioritize accounts for payment collection and. (12) The false representation or implication that accounts have been turned over to innocent purchasers for value. (13) The false representation or implication. When a Collection Agency Steps in · 1. Determine the Details of the Debt · 2. Inaccuracies? Dispute Them · 3. Negotiate With the Creditor · 4. Hire a Credit Repair. Garnishment of Bank Account | Tell the Court that the Debt is Paid remove unexempted money from your account (request for Judgment Garnishment).

Highest Interest On Money Market Accounts

:max_bytes(150000):strip_icc()/money-market-account-vs-highinterest-checking-account-which-better-v1-af34686e14ce4eb5a140c72e4b6abfbb.jpg)

Compare our money market funds ; Fund · Vanguard Treasury Money Market Fund ; Initial investment $3, ; Average 7-day SEC yield as of. September 03, · %. Open a Sallie Mae Money Market Account. Earn a high-interest rate, get access to your money, write checks, and pay no monthly fees. The best money market accounts are offering up to % APY from First Internet Bank and % APY from Vio Bank. Interest Rate Up to $2, · Opening Deposit · Build your savings and earn up to % APY · Product Benefits · Money Market Select Account and Money Market Select. Money market accounts provide many of the conveniences of a typical savings account but with a major added benefit — they often offer higher rates than. Best Money Market Account Interest Rates As of Aug. 19, , the national average rate for money market accounts was %, according to the FDIC. One of the. Our top picks for best money market account rates are Vio Bank (%), Quontic Bank (%) and EverBank (%). All are free of monthly fees. UFB Freedom Checking is a non-interest-bearing account. To receive the additional % Annual Percentage Yield (APY) on a UFB Savings or Money Market account. UFB's MMA had one of the highest interest rates, clocking in at a % APY. If you're seeking a higher APY, a money market account offers higher interest. Compare our money market funds ; Fund · Vanguard Treasury Money Market Fund ; Initial investment $3, ; Average 7-day SEC yield as of. September 03, · %. Open a Sallie Mae Money Market Account. Earn a high-interest rate, get access to your money, write checks, and pay no monthly fees. The best money market accounts are offering up to % APY from First Internet Bank and % APY from Vio Bank. Interest Rate Up to $2, · Opening Deposit · Build your savings and earn up to % APY · Product Benefits · Money Market Select Account and Money Market Select. Money market accounts provide many of the conveniences of a typical savings account but with a major added benefit — they often offer higher rates than. Best Money Market Account Interest Rates As of Aug. 19, , the national average rate for money market accounts was %, according to the FDIC. One of the. Our top picks for best money market account rates are Vio Bank (%), Quontic Bank (%) and EverBank (%). All are free of monthly fees. UFB Freedom Checking is a non-interest-bearing account. To receive the additional % Annual Percentage Yield (APY) on a UFB Savings or Money Market account. UFB's MMA had one of the highest interest rates, clocking in at a % APY. If you're seeking a higher APY, a money market account offers higher interest.

Open a new Truist One Money Market Account and earn % annual percentage yield (APY). Offer available to new Truist One Money Market Account clients only. A Money Market fund is a mutual fund that invests in short-term, higher quality securities. Designed to provide high liquidity with lower risk. Like savings accounts, money market accounts pay interest, although at a generally higher rate than a savings account. Interest on money market accounts is. Higher rates worth your interest ; $25, - $49, %. % ; $50, - $99, %. % ; $, - $, %. % ; $, -. Compare Relationship Money Market Account Interest Rates ; %. %. %. %. Money market account need to know. · There is a required minimum account balance and opening deposit of $10, in new money. · If the minimum daily balance. A cash management account, which can offer safety and easy access to your money with higher interest rates than regular savings accounts. A money market fund. Compare Rates ; Max Money Market - $25, - $49, %. % ; Max Money Market - $50, - $99, %. % ; Max Money Market - $, - $, Money market accounts provide many of the conveniences of a typical savings account but with a major added benefit — they often offer higher rates than. Open a Sallie Mae Money Market Account. Earn a high-interest rate, get access to your money, write checks, and pay no monthly fees. Earn % interest rate (% blended APY) for 6 months. See how · Rate available on balances of $25, to $1,, with an increase in total. Unlike other types of high interest savings accounts, you can write checks from your money market savings account. With the Fifth Third Relationship Money. Earn up to % Annual Percentage Yield (APY) · Let's find interest rates for the Relationship Plus Money Market account based on your location. · Save smarter. High Yield Money Market Investment Account · Maximize savings and liquidity · % APY · Features and services to help you reach your goals · Get started · Rates &. Money markets and money market IRAs ; Under $2,, · ; $2,–$9,, · ; $10,–$24,, · ; $25,–$49,, · ; $50,–. account, but with tiered interest rates that may pay more for higher balances than a standard savings account. Plus, you can access your funds at any time. Open a Retirement Money Market account and build out a retirement plan 6 that helps you: Diversify your retirement portfolio; Enjoy competitive, tiered interest. High Yield Money Market Account Rates · $0-$ · % · $1,+ · %. Discover's Money Market account gets you high interest rates, no fees and lets you access your cash via ATM, debit card and checks. Open a money market. Ally Bank's Money Market Account comes with a competitive % APY, and that rate applies to all balance.

Banks That Offer Representative Payee Accounts

Get faster and smarter disbursements with digital and mobile disbursement solutions for all your payees through the U.S. Bank Payee Choice service today. How to title an account. If you are a rep payee. For bank accounts. (Name of beneficiary) by (Your name), representative payee. OR. (Your name), representative. A Representative Payee allows an individual appointed by the Social Security Administration to receive and manage SSI benefits for another. SSA requires a representative payee to perform the following duties: Manage funds so the beneficiary has no unmet needs;; Account for all funds received and. A Social Security representative payee is appointed by the Social Security Administration / Bank accounts and services. last reviewed: JUN 27, What is a Social Security representative payee? When a representative payee account is opened, we monitor daily debit transactions to make sure that the beneficiary of the funds is not signing checks. River City Bank provides trustworthy Representative Payee services to make managing finances easier for government benefit recipients, seniors. As Roberto's fiduciary, you might pay bills or taxes, oversee bank accounts, pay for How to title an account if you are a rep payee. TYPE OF ACCOUNT. A representative payee bank account is a type of bank account designed to receive and hold funds for a beneficiary of the Social Security Administration (SSA). Get faster and smarter disbursements with digital and mobile disbursement solutions for all your payees through the U.S. Bank Payee Choice service today. How to title an account. If you are a rep payee. For bank accounts. (Name of beneficiary) by (Your name), representative payee. OR. (Your name), representative. A Representative Payee allows an individual appointed by the Social Security Administration to receive and manage SSI benefits for another. SSA requires a representative payee to perform the following duties: Manage funds so the beneficiary has no unmet needs;; Account for all funds received and. A Social Security representative payee is appointed by the Social Security Administration / Bank accounts and services. last reviewed: JUN 27, What is a Social Security representative payee? When a representative payee account is opened, we monitor daily debit transactions to make sure that the beneficiary of the funds is not signing checks. River City Bank provides trustworthy Representative Payee services to make managing finances easier for government benefit recipients, seniors. As Roberto's fiduciary, you might pay bills or taxes, oversee bank accounts, pay for How to title an account if you are a rep payee. TYPE OF ACCOUNT. A representative payee bank account is a type of bank account designed to receive and hold funds for a beneficiary of the Social Security Administration (SSA).

A Representative Payee is an individual that receives Social Security and/or Supplemental Security Income (SSI) payments for someone who cannot manage or. directly into a separate banking account. We call this a “dedicated account” because funds in this account may be used only for certain expenses, primarily. Now, a representative payee can open and manage an ABLEnow account for an eligible individual. This short course covers banking basics, managing your accounts The date of birth for a fiduciary (i.e. Rep Payee, Trustee) is not eligible for the waiver. Recommendation is US Bank. All they need is Rep Payee and beneficiary's SS cards and State ID / Driver License as well as an SS official letter. Here are just some of the capabilities that make AccuFund a trusted partner to representative payee organizations nationwide: Combine individual accounts into. A representative payee account is for those who need to have a family member or trusted friend help with their finances. representative payee deposited funds for several people in a common bank account. offer the same types of consumer protections that bank accounts do. Through our Representative Payee Program, we help ensure certain social security beneficiaries are protected from financial exploitation and other abuses. If you're an eligible beneficiary with a Representative Payee, you can open an account for yourself. If you have legal capacity, you may select a. You must save any money left after you pay for the beneficiary's needs, preferably in U.S. Savings. Bonds or an interest-paying bank account. This must be. Consumer Account Disclosure: Contains rates and fees associated with the accounts and services offered To terminate access to Accounts through Online. Banking. Security Number), for whom (Name of Payee) is. Representative Payee for Social Security funds. C. Various forms of accounts recognized by banks, trust. To set up an account with a Representative Payee, you can obtain an electronic form by visiting your nearest Service Center or contacting Member Relations at. Doing so simply involves going to any bank and asking to set up a Representative Payee account. Representative Payee accounts show the beneficiary as the owner. for the primary ID. We will also accept a current paystub, utility bill, insurance card, bank statement, student/employee ID, or car registration. This is required for all personal account types including Rep Payee* and UTMA** accounts. We offer traditional deposit and loan services as well as. A representative payee is appointed by the Social Security Administration for another person who needs help managing their Social Security or Supplemental. Representative Payees use True Link for dozens, hundreds, or even thousands of clients. 2. Fund online from existing bank accounts. chevron. Fund your clients.

How Much Is A Dollar In Mexico Pesos

:max_bytes(150000):strip_icc()/168317996-56a3ea483df78cf7727fdc5f.jpg)

Mexican Peso to US Dollar conversion ; 10 MXN, USD ; 25 MXN, USD ; 50 MXN, USD ; MXN, USD ; MXN, USD. Further Information United States Dollar - Mexican Peso ; Close, , Open ; USD · $ , $ ; MXN · $ , $ Check today's US Dollar to Mexican Peso exchange rate with Western Union's currency converter. Send USD and your receiver will get MXN in minutes. Find out how much 1 US dollars is worth in about Mexican pesos. Convert 1 US dollars with Alpari's online currency converter. USD/MXN - US Dollar Mexican Peso · Prev. Close: · Bid/Ask: / · Day's Range: - Latest Currency Exchange Rates: 1 Mexican Peso = US Dollar · Currency Converter · Exchange Rate History For Converting Mexican Pesos (MXN) to Dollars (USD). 1 USD = MXN Sep 03, UTC Check the currency rates against all the world currencies here. The currency converter below is easy to use and. I have a pesos dated Can you tell me what it is worth today in American money? Shirley Holman. exspired mexican peso (). how much. US Dollars to Mexican Pesos conversion rates ; 1 MXN, USD ; 5 MXN, USD ; 10 MXN, USD ; 25 MXN, USD. Mexican Peso to US Dollar conversion ; 10 MXN, USD ; 25 MXN, USD ; 50 MXN, USD ; MXN, USD ; MXN, USD. Further Information United States Dollar - Mexican Peso ; Close, , Open ; USD · $ , $ ; MXN · $ , $ Check today's US Dollar to Mexican Peso exchange rate with Western Union's currency converter. Send USD and your receiver will get MXN in minutes. Find out how much 1 US dollars is worth in about Mexican pesos. Convert 1 US dollars with Alpari's online currency converter. USD/MXN - US Dollar Mexican Peso · Prev. Close: · Bid/Ask: / · Day's Range: - Latest Currency Exchange Rates: 1 Mexican Peso = US Dollar · Currency Converter · Exchange Rate History For Converting Mexican Pesos (MXN) to Dollars (USD). 1 USD = MXN Sep 03, UTC Check the currency rates against all the world currencies here. The currency converter below is easy to use and. I have a pesos dated Can you tell me what it is worth today in American money? Shirley Holman. exspired mexican peso (). how much. US Dollars to Mexican Pesos conversion rates ; 1 MXN, USD ; 5 MXN, USD ; 10 MXN, USD ; 25 MXN, USD.

Download Our Currency Converter App ; 1 USD, MXN ; 5 USD, MXN ; 10 USD, MXN ; 20 USD, MXN.

/09/ USD TO MXN TODAY Current USD to MXN exchange rate equals Mexican Pesos per 1 Dollar. Today's range: Yesterday's rate. How much is 1 US Dollar in Mexican Pesos? 1 US Dollar = Mexican Pesos as of September 3, AM UTC. You can get live exchange rates between US. This Free Currency Exchange Rates Calculator helps you convert Mexican Peso to US Dollar from any amount. How much does it cost to send money to Mexico? · Does Remitly offer discounts for new customers? · How can I pay for my money transfer? · What are the ways to. US Dollars to Mexican Pesos conversion rates ; 10 USD, MXN ; 25 USD, MXN ; 50 USD, MXN ; USD, 1, MXN. Historical Exchange Rates For United States Dollar to Mexican Peso · Quick Conversions from United States Dollar to Mexican Peso: 1 USD = MXN. Latest Currency Exchange Rates: 1 US Dollar = Mexican Peso · Currency Converter · Exchange Rate History For Converting Dollars (USD) to Mexican Pesos (MXN). Not impressed by Big Tech in Q3? Explore these Blue Chip Bargains USD/MXN - US Dollar Mexican Peso News & Analysis · Mexico stocks lower at. Mexican Peso. The USDMXN spot exchange rate specifies how much one currency, the USD, is currently worth in terms of the other, the MXN. While the USDMXN. US Dollar/Mexican Peso FX Spot Rate MXN=:Exchange ; Open ; Prev Close ; Day High ; Day Low Convert US Dollar to Mexican Peso ; 1 USD, MXN ; 5 USD, MXN ; 10 USD, MXN ; 25 USD, MXN. USD to MXN | historical currency prices including date ranges, indicators, symbol comparison, frequency and display options for Mexican Peso. 1 MXN = USD Sep 02, UTC Check the currency rates against all the world currencies here. The currency converter below is easy to use and. Our Dollar to Mexican Peso conversion tool gives you a way to compare the latest and historic interbank exchange rates for USD to MXN · Currency Menu. US Dollar to Mexican Peso Exchange Rate is at a current level of , up from the previous market day and up from one year ago. The fastest and simplest converter from US Dollar to Mexican Peso and from Mexican Peso to US Dollar. Setting the currencies every time is not needed. A simple currency converter from United States Dollar to Mexican Peso and from Mexican Peso to United States Dollar. This application includes the following. The exchange rate for US dollar to Mexican pesos is currently today, reflecting a % change since yesterday. Over the past week, the value of US. Get US Dollar/Mexican Peso FX Spot Rate (MXN=:Exchange) real-time stock quotes, news, price and financial information from CNBC.

1 2 3 4 5