chel-olimp.ru

Community

Aurora Solar Stock Price

Get Aurora Solar Technologies Inc (ACU-V:Canadian Ventures Exchange) real-time stock quotes, news, price and financial information from CNBC. Key Stock Data · P/E Ratio (TTM). N/A · EPS (TTM). $ · Market Cap. $ M · Shares Outstanding. M · Public Float. M · Yield. AACTF is not. ACU | Complete Aurora Solar Technologies Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. In depth view into ACU.V (Aurora Solar Technologies) stock including the latest price, news, dividend history, earnings information and financials. Get today's stock prices, news and investor discussion about Aurora Solar Technologies Inc (TSXV:ACU). Research ACU stock prices, stock quotes, stock trends. Find the latest Aurora Solar Technologies Inc. (ACU.V) stock quote, history, news and other vital information to help you with your stock trading and. Discover real-time Aurora Solar Technologies Inc (AACTF) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Get the latest stock price for Aurora Solar Technologies Inc. (ACU), plus the latest news, recent trades, charting, insider activity, and analyst ratings. Price History & Performance ; Current Share Price, CA$ ; 52 Week High, CA$ ; 52 Week Low, CA$ ; Beta, Get Aurora Solar Technologies Inc (ACU-V:Canadian Ventures Exchange) real-time stock quotes, news, price and financial information from CNBC. Key Stock Data · P/E Ratio (TTM). N/A · EPS (TTM). $ · Market Cap. $ M · Shares Outstanding. M · Public Float. M · Yield. AACTF is not. ACU | Complete Aurora Solar Technologies Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. In depth view into ACU.V (Aurora Solar Technologies) stock including the latest price, news, dividend history, earnings information and financials. Get today's stock prices, news and investor discussion about Aurora Solar Technologies Inc (TSXV:ACU). Research ACU stock prices, stock quotes, stock trends. Find the latest Aurora Solar Technologies Inc. (ACU.V) stock quote, history, news and other vital information to help you with your stock trading and. Discover real-time Aurora Solar Technologies Inc (AACTF) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Get the latest stock price for Aurora Solar Technologies Inc. (ACU), plus the latest news, recent trades, charting, insider activity, and analyst ratings. Price History & Performance ; Current Share Price, CA$ ; 52 Week High, CA$ ; 52 Week Low, CA$ ; Beta,

What is Aurora Solar Technologies Inc(AACTF)'s stock price today? The current price of AACTF is $ The 52 week high of AACTF is $ and 52 week low is. Aurora Solar current valuation; Aurora Solar stock price; Available deals in Aurora Solar and all other companies; Deal offering documents; EquityZen's. Get Aurora Solar Technologies Inc (AACTF:OTCPK) real-time stock quotes, news, price and financial information from CNBC. Aurora Solar Technologies (A82) Stock Price & Analysis ; Volume ; Average Volume (3M)K ; Market Cap. €M ; Enterprise Value€M ; Total Cash (Recent. Aurora Solar Stock Price. Aurora Solar does not have a publicly available stock price because it is privately held and not traded on public stock exchanges. Stock analysis for Aurora Solar Technologies Inc (AACTF:OTC US) including stock price, stock chart, company news, key statistics, fundamentals and company. Discover all the factors affecting Aurora Solar Technologies's share price. ACU is currently rated as a Neutral | Stockopedia. Aurora Solar Technologies Inc. ; YTD Change. % ; 12 Month Change. % ; Day Range - ; 52 Wk Range - ; Market Value, $M. The current price of ACU is CAD — it hasn't changed in the past 24 hours. Watch AURORA SOLAR TECHNOLOGIES INC stock price performance more closely on the. Aurora Solar Technologies Inc. (AACTF.): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock Aurora Solar Technologies Inc. Aurora Solar Stock $ | How to Buy, Valuation, Stock Price, IPO | chel-olimp.ru Real-time Price Updates for Aurora Solar Technologies Inc (ACU-X), along with buy or sell indicators, analysis, charts, historical performance. The last closing price for Aurora Solar Technologies was $ Over the last year, Aurora Solar Technologies shares have traded in a share price range of $. Aurora Solar is selling for under as of the 14th of July ; that is percent decrease since the beginning of the trading day. The stock's lowest day. Aurora Solar Technologies Inc (ACU) has a Smart Score of N/A based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom. Stock analysis for Aurora Solar Technologies Inc (ACU:Venture) including stock price, stock chart, company news, key statistics, fundamentals and company. Market Value, $M ; Shares Outstanding, M ; EPS (TTM), $ ; P/E Ratio (TTM), N/A ; Dividend Yield, N/A. The latest Aurora Solar Technologies stock prices, stock quotes, news, and AACTF history to help you invest and trade smarter. What Is the Aurora Solar Technologies Inc Stock Price Today? The Aurora Solar Technologies Inc stock price today is What Is the Stock Symbol for. Aurora Solar Technologies Stock (OTC: AACTF) stock price, news, charts, stock research, profile.

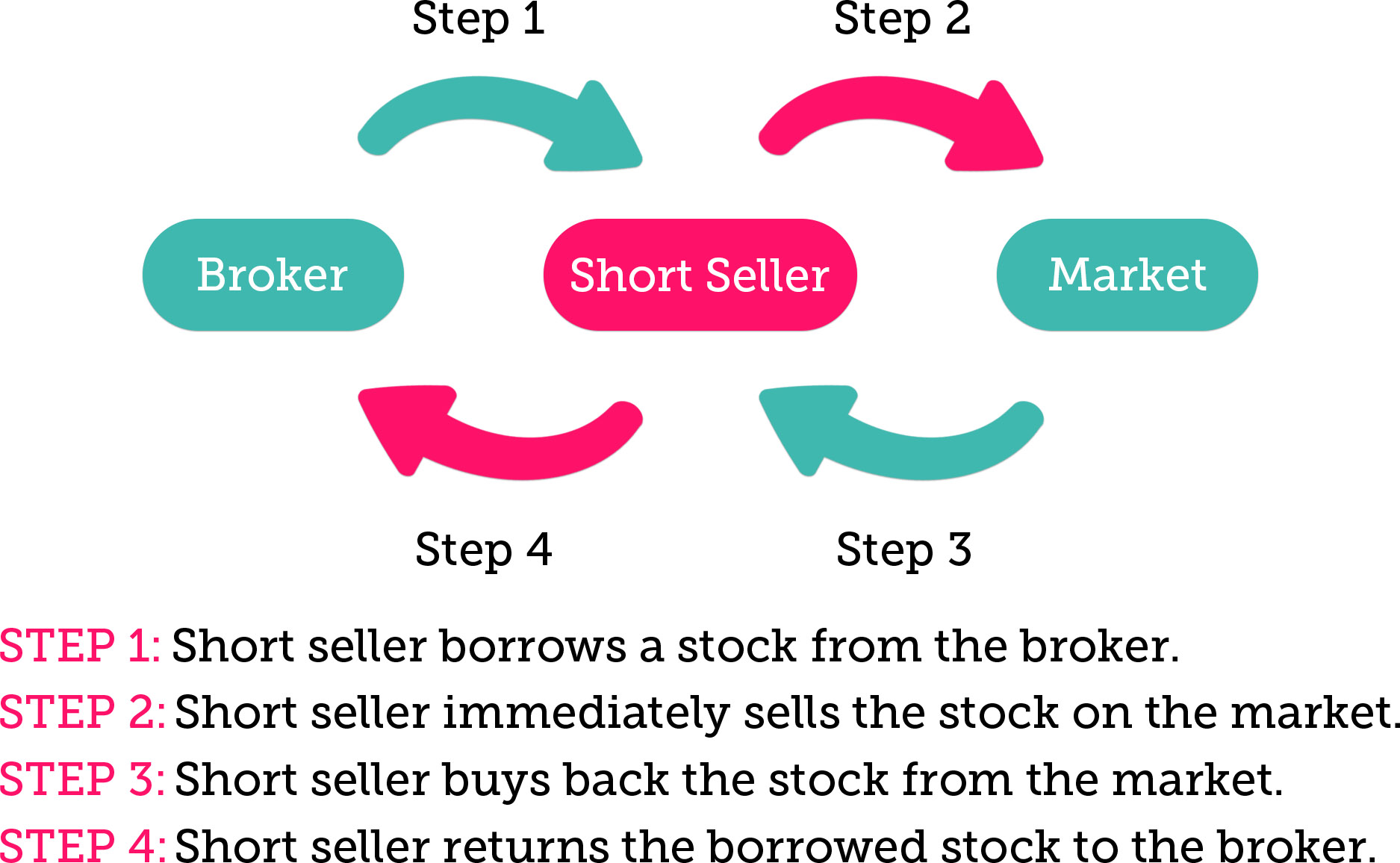

What Is Short Selling In Stock Market With Example

To short-sell a stock, you borrow shares from your brokerage firm, sell them on the open market and, if the share price declines as hoped and anticipated, buy. The process of short selling a stock involves borrowing the stock and therefore trading on margin. This means there are fees and interest payments involved. Short selling—also known as “shorting,” “selling short” or “going short”—refers to the sale of a security or financial instrument that the seller has borrowed. Short sell exempt: The seller expects to own the stock by settlement date, for example, from delivery from an options trade. Effectively, these are treated as. It is possible to make a lot of money by short selling because stocks and markets tend to fall much faster than they rise. For example, while the S&P Shorting a stock is a trading strategy where an investor tries to make money when a stock's price declines. Learn more about how shorting a stock works. Selling short is primarily designed for short-term opportunities in stocks or other investments that you expect to decline in price. The primary risk of. Short selling occurs when an investor borrows a security and sells it on the open market, planning to buy it back later for less money. Short-sellers bet on. To short the company's stock, the investor borrows shares from a brokerage and sells those shares in the market, which are technically not owned by the firm. To short-sell a stock, you borrow shares from your brokerage firm, sell them on the open market and, if the share price declines as hoped and anticipated, buy. The process of short selling a stock involves borrowing the stock and therefore trading on margin. This means there are fees and interest payments involved. Short selling—also known as “shorting,” “selling short” or “going short”—refers to the sale of a security or financial instrument that the seller has borrowed. Short sell exempt: The seller expects to own the stock by settlement date, for example, from delivery from an options trade. Effectively, these are treated as. It is possible to make a lot of money by short selling because stocks and markets tend to fall much faster than they rise. For example, while the S&P Shorting a stock is a trading strategy where an investor tries to make money when a stock's price declines. Learn more about how shorting a stock works. Selling short is primarily designed for short-term opportunities in stocks or other investments that you expect to decline in price. The primary risk of. Short selling occurs when an investor borrows a security and sells it on the open market, planning to buy it back later for less money. Short-sellers bet on. To short the company's stock, the investor borrows shares from a brokerage and sells those shares in the market, which are technically not owned by the firm.

Example of Traditional Short Selling Let's say that you borrow Lucid shares via your broker and then sell them at the current market price of $20 – taking. Short selling is an investment strategy where an investor borrows shares of stock from a broker and sells them in the market, hoping the price will fall. They. Short selling aims to profit from a pending downturn in a stock or the stock market. It corresponds to the trader's mantra to “buy low, sell high,” except it. To better understand the short selling meaning, you can take a look at a simple example. Let's assume that shares of the N company are trading at $, but you. Selling short means selling stock you don't have, hoping to buy it back later cheaper. So if you sell for $10 a share and buy it back for $5 a. Short Selling Example · Say its price when the markets open on Monday is $ · In regular trading, if a trader believes the price will rise, he will open a. It's what investors do when they think the price of a stock will go down. With short selling, it's about leverage. Investors sell stocks they've borrowed from a. In finance, being short in an asset means investing in such a way that the investor will profit if the market value of the asset falls. This is the opposite. Shorting a stock is a trading strategy where an investor tries to make money when a stock's price declines. Learn more about how shorting a stock works. This can include forex markets, stock markets, and all other financial markets. Shorting stocks helps increase market liquidity, as thousands of people are. The most obvious reason to short is to profit from an overpriced stock or market. Probably the most famous example of this was when George Soros "broke the. Here's a hypothetical example of short selling: You find XYZ stock valued at $ per share and believe the value will fall, so you decide to open a short. Short selling is also used by market makers and others to provide liquidity in response to unanticipated demand, or to hedge the risk of an economic long. Short Selling occurs when an investor sells all the shares that he does not own at the time of a trade. In short, a trader buys shares from the owner with the. Short selling happens when an investor sells shares that he does not own at the time of a trade. In a short sale, a trader borrows shares from the owner. Buying stocks on a Long Position is the action of purchasing shares of stock(s) anticipating the stock's value will rise over time. For example: Gary. In fact, we can also do it in a reverse order by selling a stock first and buying it later. This is called short selling. You have no stocks at hand initially. – Shorting stocks in the spot market · When you short a stock what is the expected directional move? The expectation is that the stock price would decline. For example, you just sold shares of Company Z at the current market price of $90 per share. Just like any other time when you sell stock, the money from. Short selling is an investment strategy where an investor borrows shares of stock from a broker and sells them in the market, hoping the price will fall. They.

Bdsix

BDSIX - BlackRock Advantage Small Cap Core Fund Institutional Shares has disclosed total holdings in their latest SEC filings. Track real-time price movements of BDSIX with our comprehensive chart. Make informed investment decisions with reliable data from Amassing Investment. BDSIX Price - See what it cost to invest in the BlackRock Advantage Small Cap Core Instl fund and uncover hidden expenses to decide if this is the best. VSMAX has a lower initial minimum investment than BDSIX: VSMAX () vs BDSIX (). BDSIX annual gain was more profitable for investors over the last. Bdsix Elevenbd. Posts. Photos. . See more about Bdsix. . Photos. Bdsix Elevenbd. Mar 29, . . Yummy Yummy. No photo description available. Complete history of BDSIX key financial ratios such as PE, liquidity, margins and others. View Top Holdings and Key Holding Information for BlackRock Advantage Small Cap Core Fund (BDSIX). Find the latest performance data chart, historical data and news for BlackRock Advantage Small Cap Core Fund - Institutional (BDSIX) at chel-olimp.ru A high-level overview of BlackRock Advantage Small Cap Core Fund Inst (BDSIX) stock. Stay up to date on the latest stock price, chart, news, analysis. BDSIX - BlackRock Advantage Small Cap Core Fund Institutional Shares has disclosed total holdings in their latest SEC filings. Track real-time price movements of BDSIX with our comprehensive chart. Make informed investment decisions with reliable data from Amassing Investment. BDSIX Price - See what it cost to invest in the BlackRock Advantage Small Cap Core Instl fund and uncover hidden expenses to decide if this is the best. VSMAX has a lower initial minimum investment than BDSIX: VSMAX () vs BDSIX (). BDSIX annual gain was more profitable for investors over the last. Bdsix Elevenbd. Posts. Photos. . See more about Bdsix. . Photos. Bdsix Elevenbd. Mar 29, . . Yummy Yummy. No photo description available. Complete history of BDSIX key financial ratios such as PE, liquidity, margins and others. View Top Holdings and Key Holding Information for BlackRock Advantage Small Cap Core Fund (BDSIX). Find the latest performance data chart, historical data and news for BlackRock Advantage Small Cap Core Fund - Institutional (BDSIX) at chel-olimp.ru A high-level overview of BlackRock Advantage Small Cap Core Fund Inst (BDSIX) stock. Stay up to date on the latest stock price, chart, news, analysis.

Download BlackRock Advantage Small Cap Core;Institutional stock data: historical BDSIX stock prices from MarketWatch. BDSIX. Growth of a Hypothetical $10, Investment as of 07/31/ This fund has multiple managers, view BDSIX quote page for complete information. 10, Canción son original creada por bdsix art. Mira los videos más recientes de son original en TikTok. Investor A: BDSAX • Investor C: BDSCX • Institutional: BDSIX. This Prospectus contains information you should know before investing, including information. Blackrock Advantage Small Cap Core Fund - Institutional: (MF: BDSIX). (NASDAQ Mutual Funds) As of Aug 27, PM ET. Add to portfolio. $ USD. Buy Tickets. Menu. Image with id "bDsiX" not found, published, or embeddable. Currently not on view. Share. A Wild Boar. Abraham Hondius (Dutch. Compare BDSIX and VOO based on historical performance, risk, expense ratio, dividends, Sharpe ratio, and other vital indicators to decide which may better. BDSIX. BlackRock Advantage Small Cap Core Fund Institutional Shares. Actions. Add to watchlist; Add to portfolio. Price (USD); Today's Change / %. See what Buğra (bdsix) has discovered on Pinterest, the world's biggest collection of ideas bdsix. ·. 1 seguidor. ·. Siguiendo a 6. Seguir. Investor A: BDSAX • Investor C: BDSCX • Institutional: BDSIX. Before you invest, you may want to review the Fund's prospectus, which contains more. BDSIX | A complete BlackRock Advantage Small Cap Core;Institutional mutual fund overview by MarketWatch. View mutual fund news, mutual fund market and. BDSIX's dividend yield, history, payout ratio & much more! chel-olimp.ru: The #1 Source For Dividend Investing. See holdings data for BlackRock Advantage Small Cap Core Fund (BDSIX). Research information including asset allocation, sector weightings and top holdings. BDSIX %. BlackRock Advantage Small Cap Core Fund Investor A Shares. $ BDSAX %. BlackRock Emerging Markets Fund, Inc. Institutional Shares. $ Fund Size Comparison. Both BDSIX and SWSSX have a similar number of assets under management. BDSIX has Billion in assets under management, while SWSSX has. Get the latest BlackRock Advantage Small Cap Core Fund - Institutional (BDSIX) price, news, buy or sell recommendation, and investing advice from Wall. 0 Followers, 0 Following, 0 Posts - @bdsix on Instagram: "@_robertpatrick". Find houses for rent in -水疗会所外围(高级资源)bdsix that have been renovated and transformed with functionality, aesthetics and you in mind. BlackRock Advantage Small Cap Core Fund (BDSIX) - historical returns, volatility, Sharpe ratio, dividend payments, fundamentals, and more. Find our live Blackrock Advantage Small Cap Core Fund Institutional Shares fund basic information. View & analyze the BDSIX fund chart by total assets.

How Much Do Delivery Drivers Make Uber Eats

As of Aug 29, , the average hourly pay for an Uber Eats Delivery Driver in Texas is $ an hour. While ZipRecruiter is seeing salaries as high as $ Here's why you should drive, deliver, and earn money with Uber. Drive or deliver. It's up to you how you want to earn. No other app offers the same. Average UberEATS Delivery Driver hourly pay in the United States is approximately $, which is 29% above the national average. Salary information comes from. Here's why you should drive, deliver, and earn money with Uber. Drive or deliver. It's up to you how you want to earn. No other app offers the same. An Uber Eats Delivery Driver in your area makes on average $20 per hour, or $ (%) more than the national average hourly salary of $ New York. This Uber Eats driver made $ in one month delivering food 12 hours a day. Here's how he did it — and documented the journey on Tik Tok. According to Gridwise, the average delivery driver makes $ per hour, or $ per trip. But, drivers can simply do their own calculations to determine. Base Fare: Our friends at Uber Eats typically earn a base fare per delivery, ranging from $2 to $4, depending on the market. Distance Pay: This includes trip. Uber Eats drivers can expect to make an average of $ an hour, according to Indeed. Depending on how many deliveries you make per week and the hours worked. As of Aug 29, , the average hourly pay for an Uber Eats Delivery Driver in Texas is $ an hour. While ZipRecruiter is seeing salaries as high as $ Here's why you should drive, deliver, and earn money with Uber. Drive or deliver. It's up to you how you want to earn. No other app offers the same. Average UberEATS Delivery Driver hourly pay in the United States is approximately $, which is 29% above the national average. Salary information comes from. Here's why you should drive, deliver, and earn money with Uber. Drive or deliver. It's up to you how you want to earn. No other app offers the same. An Uber Eats Delivery Driver in your area makes on average $20 per hour, or $ (%) more than the national average hourly salary of $ New York. This Uber Eats driver made $ in one month delivering food 12 hours a day. Here's how he did it — and documented the journey on Tik Tok. According to Gridwise, the average delivery driver makes $ per hour, or $ per trip. But, drivers can simply do their own calculations to determine. Base Fare: Our friends at Uber Eats typically earn a base fare per delivery, ranging from $2 to $4, depending on the market. Distance Pay: This includes trip. Uber Eats drivers can expect to make an average of $ an hour, according to Indeed. Depending on how many deliveries you make per week and the hours worked.

When demand increases, earnings for rides and deliveries go up · Keep an eye out for surge pricing to earn extra money. Uber Eats drivers actually make between $38,, per year. This number is influenced by a driver's delivery acceptance rate, schedule flexibility, and. How much do Uber Eats drivers earn? Uber drivers' earnings can vary based on However, food delivery drivers in the U.S. make an average hourly wage. How Much Do Uber Eats Drivers Make? According to ZipRecruiter, Uber Eats drivers earn an average of $ per hour. This translates to about $3, monthly and. Uber Eats drivers earn between $ and $ per hour, with annual incomes ranging from about $26, to $41, for full-time work. You will make approximately $$25 per hour. This estimate can change depending on market demand and which hours you work. You can expect to. earnings when doing gig economy food delivery through services like Uber Eats and DoorDash. Many food delivery drivers just starting out don't realize. Uber Eats delivery drivers earn anywhere from $ to $ per hour. The amount delivery partners earn depends on their location, delivery fee, surge pricing. How long does it take to become a partner? · Who handles each delivery? · What is the delivery radius? · What kinds of Uber Eats tools do merchant partners receive. Start earning. Most drivers earn $* an hour. *Actual earnings will depend on your location, any tips you receive, how long. On average, UberEats drivers usually make about $18 per hour before expenses, making this a potentially decent income. Gross earnings per trip are between $ and $ Tips make up about 50% of most Uber Eats drivers' income, which amounts to about $ per month. Is. Deliver when you want, make what you need · Be a delivery driver using Uber · Get paid to deliver · How food delivery driving works · Here's what you need to become. When demand increases, earnings for rides and deliveries go up · Keep an eye out for surge pricing to earn extra money. When you deliver with the Uber Eats app, your earnings are transferred automatically, so you don't have to worry about paperwork. Find out how to set up. The estimated total pay range for a UberEATS Delivery Driver at Uber is $16–$22 per hour, which includes base salary and additional pay. How much should you to tip your DoorDash, UberEats or Grubhub driver? Here is a guide to tipping from a long-time delivery driver. Become a delivery driver with Uber Eats to earn money on your own time How much of my delivery tips do I get to keep? Your customers have the. Uber Eats, as with many food delivery apps, pays its drivers on a piece rate. That is to say, you get paid per delivery you make, rather than per hour. The Uber Eats rate for their bike delivery staff can go up to £14 during busy hours. How Much Money Will An Uber Eats Bicycle Driver Get? As we mentioned a bit.

2 3 4 5 6